Alternative Investments Masterclass with Paul Meadows

Alternative Investments Masterclass with Paul Meadows

We are thrilled to announce the return of renowned financial expert Paul Meadows to Gibraltar for an exclusive training session on April 17, 2024. This full-day event is tailored for financial professionals, investment professionals, and fund managers seeking valuable insights into the world of 'Alternative' Investments.

Overview: Investors today are exploring 'Alternative' ideas beyond traditional Bond and Equity avenues. However, the lack of a formalized definition for 'Alternative' Investments often makes the possibilities seem overwhelming. Join us to gain a comprehensive understanding of alternative investment opportunities, their characteristics, and how to navigate this diverse landscape from both an Institutional and Private Investor perspective.

Target Audience:

Financial professionals

Investment professionals

Fund managers

Featured Speaker: Paul Meadows: With extensive experience as a trader, research analyst, and portfolio manager in the UK, Paul Meadows has been delivering financial markets training worldwide since 2000. He is also a guest lecturer at the UCL School of Management.

Workshop Topics: Explore key topics and takeaways that will shape your understanding of alternative investments:

Real Estate:

Characteristics of the Asset Class

Making Money in Real Estate - Leverage

Real Estate Investment Trusts (REITs)

Private Equity:

Fund structures & Fees

From Seed Capital to Management Buyout Funds

Understanding Returns in Private Equity

Hedge Funds:

Definition and Features

Trading Tactics, Leverage & Short Selling

Performance Fees, High Water Marks, and Risk Management

Commodities:

Influences on Commodity Prices

Physical vs. Synthetic exposure

Commodity Exchange Traded Funds (ETFs)

Crypto Currencies & NFTs:

Defining Money and Crypto as an Alternative Currency

Understanding Crypto in a Portfolio

Exploring Non-Fungible Tokens (NFTs)

Event Details:

Date: April 17, 2024

Location: Gibraltar

Price: £130 (Members) | £150 (Non-Members)

Inclusions: Breakfast, Lunch,

Registration Information: Secure your spot now! Click HERE to sign up for this exclusive masterclass with Paul Meadows. You will be invoiced after filling in the registration form.

Don't miss this opportunity to enhance your knowledge of alternative investments. Join us for a day of valuable insights, engaging discussions, and networking opportunities. We look forward to welcoming you on April 17th!

Breakfast Seminar on ‘Sustainable Investing: Strategic Minerals’ with Dr Daniel Wild

GFIA is delighted to announce that we will be hosting a Breakfast Seminar on ‘Sustainable Investing: Strategic Minerals’ with Dr Daniel Wild, a highly respected thought leader within the sustainable asset management industry.

Minister Cortes, Minister for Environment will be opening the session for guests.

Event Details:

Date: Thursday, March 7, 2024

Time: 9am – 10.30am (Breakfast served from 9am)

Venue: Sunborn Hotel, Gibraltar

Cost: £35 members / £50 non-members (You will be invoiced once you register)

Dr Wild’s talk will outline the key considerations for investors when it comes to sustainable investing, and demonstrate approaches to address climate and biodiversity risks in investments.

Content

In the main part of the seminar we will cover the controversial topic of ‘Strategic Minerals’ as society transitions toward a greener future, which is highly dependent on the mining industry and value chain. Dr. Wild will discuss sustainability challenges linked to this secular trend and highlight opportunities within equity and commodity markets to build exposures whilst dealing with environmental and social shortcomings.

Topics covered:

Sustainable investing: general introduction (rationale, concepts, significance, markets)

Creating a sustainable investable universe: industry approaches to ESG methodology, handling climate and biodiversity risks, JSS proprietary tools

Overview on update on the latest developments in EU SFDR (Sustainable Finance Disclosure Regulation)

Key Topic: Strategic Minerals. Solving the conundrum of the energy transition and the increased need for mining and metals under sustainability considerations.

Speaker

Daniel Wild has been Chief Sustainability Officer at Bank J. Safra Sarasin since March 2022. He is responsible for further developing the existing sustainability strategy and the proprietary ESG analysis, and coordinates all sustainability-related processes and product offerings. Daniel Wild has held leadership roles for over 20 years in sustainability and investment management. Before joining the Bank, he was Credit Suisse’s Global Head of ESG Strategy for two years. In 2018, Daniel Wild was promoted to Co-CEO of RobecoSAM AG, after having headed the Sustainability Investing Research and Development team for 11 years. In addition, he was an advisory member of the Executive Committee at the Dutch parent, Robeco. Prior to this, he led infrastructure financing programs in Southeastern Europe and Asia for the Swiss State Secretariat for Economic Affairs (SECO) from 2004 to 2006 after having headed the Environmental Technology Department at EBP since 1999.

Daniel Wild holds a Master’s in Chemical Engineering from the Swiss Federal Institute of Technology, ETH Zurich. He earned his PhD in Environmental Engineering from ETH Zurich, followed by postdoctoral research at Stanford University, USA.

Daniel Wild gave lectures on sustainability investing at the European Business School and AZEK University, and served in various advisory functions at organizations such as Global Reporting Initiative (GRI) or United Nations Environment Programme Finance Initiative (UNEP FI). Furthermore, he is a member of the Board of Trustees of the Swiss Climate Foundation, the Focus Group Regulatory of Swiss Sustainable Finance (SSF), and the Expert Commission Sustainable Finance of the Swiss Banking Association (SBA).

GANT & GFIA Joint Christmas Bash 2023

Gibraltar Funds and Investment Association

INVITATION

GANT and GFIA Christmas Party

'Tis the season to be jolly, and the Gibraltar Funds and Investment Association (GFIA) is delighted to invite you to our much-anticipated GANT and GFIA Christmas Party!

In celebration of another successful year, we warmly welcome you to join us for an unforgettable evening filled with merriment, good company, and festive cheer. This event is our way of expressing our gratitude for your continuous support and dedication to the mutual funds and investment industry.

Event Details:

Date: Wednesday, December 6, 2023

Time: 5:30 PM onwards

Venue: The Queens Picture House and Eatery

Free workshop to begin at 5:30pm on Social Media, 6pm the Christmas party starts !

Highlights of the Evening:

We will be starting the evening with a FREE 30 min training session on Social Media. More details to follow…

However if you are unable to join the social media session still come later to the Christmas Drinks !

RSVP:

Kindly RSVP by 24th November , to confirm your attendance. We kindly request you to include the names of any accompanying guests so that we can plan accordingly.

We eagerly anticipate your presence at the GANT and GFIA Christmas Party, bringing together the finest minds in the industry for a night of festive delight.

Training Session on Social Media & Marketing

Presenter: Vincent Carrié

Founder & Director, Purple Media

Vincent is the founder and director of local media agency Purple Media, who will be taking you through the latest social media marketing skills and tools relevant to our industry. With over 15 years of experience in the media and marketing industry, prior to moving to Gibraltar, Vincent has had the chance to work in large media agencies in Asia, France and the UK focussing on finance and investment companies such as M&G or AXA Investment Management.

Funds and Asset Managers Lunch - Save the Date - Funds and Asset Managers Lunch in London

Albert Isola, Minister for Digital and Financial Services, HM Government of Gibraltar is delighted to announce the date for our Funds and Asset Managers Lunch in London.

Technical Markets Training

GFIA is delighted to welcome back Paul Meadows to Gibraltar to deliver a full day of in-depth training on 17 October 2023 hosted on the Sunborn.

The day will be split into two sessions – morning and afternoon – which can be booked as a full day (with cost-savings!) or separate sessions to cater to your individual and firm training and CPD requirements.

Gibraltar Digital and Crypto Funds Conference

We are delighted to announce that The Gibraltar Digital and Crypto Funds conference is taking place on Thursday 14 September on the Sunborn. The event supported by local firms, GFIA, GANT and Gibraltar Finance aims to attract the international crypto and digital asset industry to Gibraltar. The event will focus on helping funds gain a better understanding of Gibraltar's regulatory framework and how it, along with the wider service industry, can promote investor protection and foster innovation within a secure environment.

For more information on how to attend please click the button

GFIA AGM 2023

GFIA will be holding its Annual General Meeting on Wednesday 5th July at 9:00 am. This year the AGM will be hosted in-person at Bank J Safra Sarasin (Gibraltar Ltd). We will be serving breakfast from 9:00am with the AGM to start by 9:30am

We would like to invite ALL Members of GFIA to participate in the AGM. If you would like to do so please click below to RSVP.

The current Executive Committee will be standing for re-election. Please see more information on the current committee HERE

If you would like to stand for election, please notify us via email 7 days prior to the meeting. We will then inform all members who will be standing for election. If you would like to add another business item to the agenda please send it to this email address no later than 7 days prior to the meeting and we will add it to the agenda.

GFIA's constitution can be read HERE

We look forward to seeing you on the 5th July and appreciate your continued support.

If you would like to attend virtually please feel free to let us know so we can accommodate this.

If you are unable to fill in the form once you click the RSVP please email the coordinators at info@gfia.gi

Online ESG Seminar

Sign up for a ESG Online Session with Deloitte !

Join us for an enlightening session where we delve into the world of Environmental, Social, and Governance (ESG) frameworks, regulations, and invaluable lessons from the Funds and Investment Management sector in the U.K.

In this thought-provoking session, we will explore the ever-evolving landscape of ESG, examining the regulatory frameworks that govern sustainable investing. Gain a deep understanding of the key considerations and best practices in integrating ESG factors into investment decision-making processes.

Our expert speakers, with their extensive industry experience, will share real-world insights and practical examples, illustrating the challenges and opportunities presented by ESG integration in the Funds and Investment Management sector.

Our speakers are :

Arianne Costa, Senior Manager - Deloitte Limited

Isha Gupta - Regulatory specialist Manager - Deloitte LLP

Ido Eisenberg - Head of Investment Management & Wealth - ESG advisory team at Deloitte LLP

Morgan Jones - ESG Sustainable Finance - Director at Deloitte LLP

Whether you're a seasoned professional in the investment field or new to ESG, this session will provide you with valuable knowledge and tools to enhance your understanding of ESG regulations, strategies, and implementation. Expand your expertise and stay ahead of the curve in this rapidly growing and influential sector.

Register now to secure your spot and embark on a journey toward a more sustainable future!

Click the button below to register, our coordinators will send you an invoice and once this is paid will then send you the attendance link. Price for this seminar is : £20 for members / £35 for non members

The GFIA GALA Dinner 2023

Buy Your Ticket Today!

We will be hosting the highly anticipated GFIA Gala Dinner at Alameda Gardens on the 1st June, 7pm start. After the amazing success of last year * Remember HERE *

Hurry to secure your table in advance.

Tables can be reserved for £1500 or £150pp. To purchase a table / ticket please email the team at info@gfia.gi

The dinner will be Venetian themed, black tie event.

GFIA Hedge Fund Seminar: The Case for Hedge Funds with Headstart Advisors

GFIA will be hosting a seminar on Hedge Funds.

The Main presenter is Mr Najy Nasser,CIO of Headstart Advisors Ltd

Introduction by Tim Rickson

Mr Najy Nasser is the Chief Investment Officer at Headstart Advisers Ltd. Prior to joining Headstart in 1997, Najy was Chief Investment Officer at Arab Commerce Bank where he was also head of proprietary trading, having previously managed their proprietary asset allocation, traded Foreign Exchange Strategies and been active in international merchant banking deals on behalf of the bank. Najy began his career in 1987 with AMRO Bank and their wholly owned merchant bank, Pierson Heldring & Pierson in Hong Kong and Holland. He graduated from the London School of Economics with an MSc in Accounting and Finance and holds a BA in Business Administration and Economics.

Headstart Fund of Funds has won a number of awards and was nominated for the HFM European Performance awards for 2022.

* HFM Week European Performance Awards 2016: Winner Fund of Hedge Funds long-term performance (5 years) under $1bn.

* Hedge Funds Review 12th Annual European Fund of Hedge Funds Awards 2013: Best Sub $250m FoHF

* World Finance: Hedge Fund Awards 2013: Best Diversified FoHF Europe

* 2014 International Hedge Fund Awards: Winner of Diversified Fund of Hedge Funds of the Year

* HFM Week European Performance Awards 2014: Winner of Fund of Hedge Funds Multi-Strategy – under $500m Award

* AIHF Awards 2015: Best Diversified Fund of Hedge Funds and Best Global Diversified Multi-Strategy Fund of Hedge Funds – UK

The cost of the seminar is £20 members £35 non members.

If you would like to come to this event please click the button below. Once you register, your company will then be invoiced.

An Evening at Vicky's Kitchen

GFIA are hosting their next social event at Vicky’s Kitchen in her Natural High Dining Area.

There will be a selection of Vicky’s finest canapes and wine. Spaces are limited and tickets will be issued on a first come, first serve basis. Email us today to reserve your ticket at info@gfia.gi.

There is no charge for this event.

Crypto Risk Management Seminar

GFIA will be hosting a seminar on Crypto Risk Management on the 16th February at The Sunborn, Gibraltar.

The session will open with a networking breakfast and then follow to a panel discussion.

9:15 Breakfast

9:30 -10:30 Panel Discussion, followed by a Q&A

The session is designed towards those with an interest of fund governance and could be of great interest to those who are EIF Directors but is open to our whole membership who feel they can benefit from learning about risk management in the crypto world,which is very different to risk management in traditional assets, markets and trading.

The panellists confirmed so far are :

Alon Gol, Mikko Ohtamaa, Benjamin Ittah, Roei Bar Aviv and Philip Vasquez,

The panellists have been chosen due to their unique role in crypto markets will have lots to say on risk management, each with a different perspective.

The cost of the seminar is £35 members £50 non members.

If you would like to come to this event please email our coordinators at info@gfia.gi or by clicking the button below.

The Secret to Corporate Governance - A Live Role Play

The Secret to Corporate Governance -

A Live Role Play

Join us for a live role play on effective directorships and regulation. This is an interactive and no holds barred session, suitable for all financial services industry sectors. We recommend to all those within the financial services industry.

This event is free but please do register so we are aware of numbers.

GFIA Discussion on LP Legislation

GFIA are pleased to announce that committee member Jonathan Garcia will be facilitating an interactive session on the Limited Partnerships Legislation on 15th December 2022.

Limited partnerships were first introduced in Gibraltar in 1927. The legislation has hardly been amended since, until 2021, when a major overall took place. The new legislation has been in place for just over a year. GFIA is seeking views on how the industry has adapted to the new legislation and having had the opportunity to work with this legislation for this period, whether there are certain areas that members consider should be improved. A session will therefore be held for these purposes. Please note that the purpose of the session is to exchange views and thoughts in an interactive way.

If you would like to register for this session please click HERE

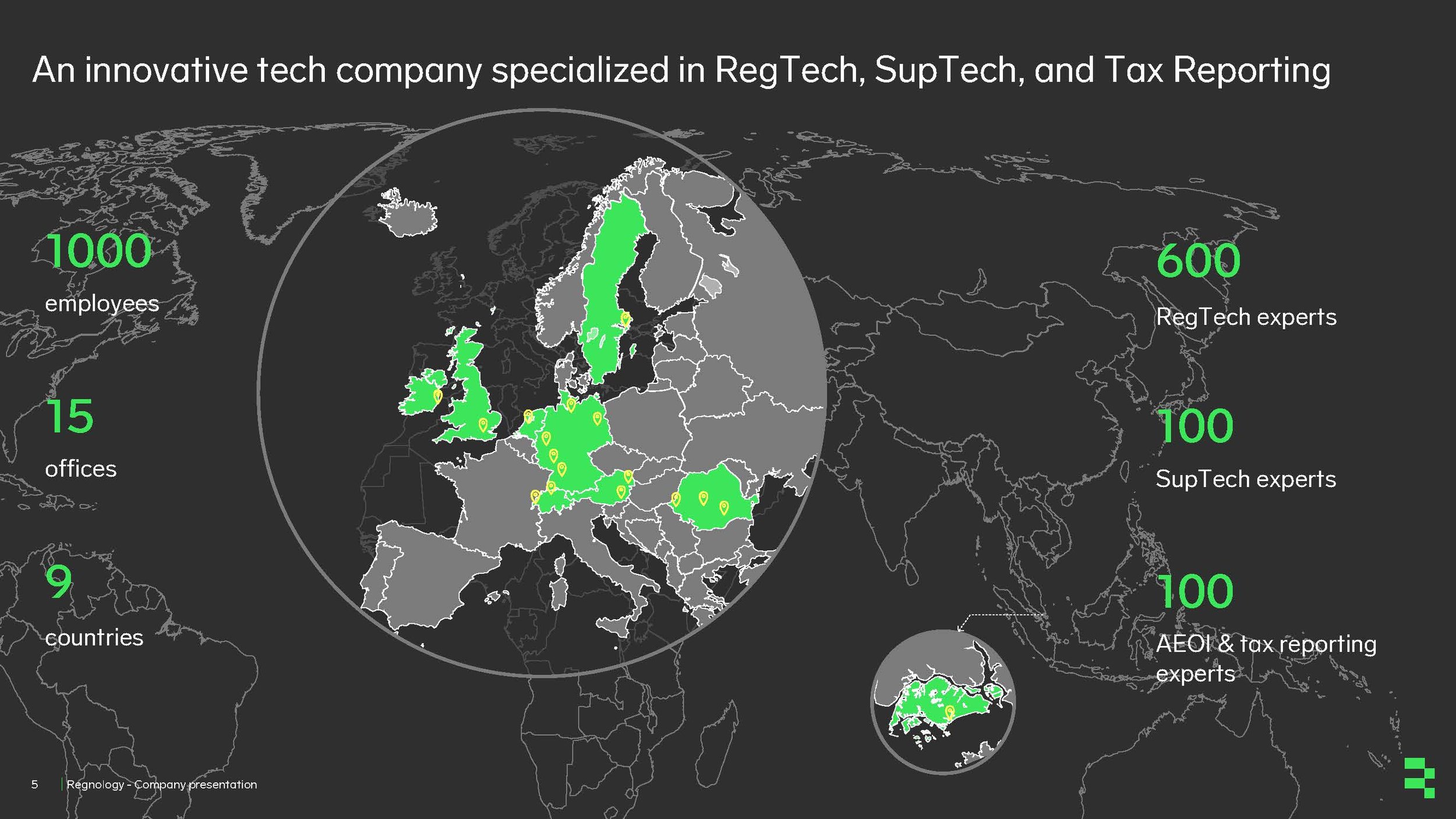

GANT & GFIA : Tax Seminar 2022 - FITAX Regnology

Exciting Webinar with speakers organised from Regnology who will give a training session to our membership on FATCA/CRS reporting and upcoming OECD / DAC requirements going live next year. To attend this webinar your company will be charged £20 pp. You will be invoiced after you register for this webinar.

The Funds & Asset Managers’ Breakfast

Gibraltar Day 2022 The Funds & Asset Managers’ Breakfast will take place on Wednesday 2nd November 2022

Submitting a Suspicious Activity Report and the Consent Regime

As part of the GFIU’s outreach program Project Nexus, it is delivering a short presentation that will focus on improving the quality of Suspicious Activity Reports. It will also discuss the Consent regime under the Proceeds of Crime Act 2015 and explain the terminology used by GFIU to describe consent. Other topics that will be covered are the functions of the GFIU, the online reporting system, and how to obtain guidance and further awareness training from the GFIU.

GFIA Gala Dinner - SOLD OUT

THIS EVENT HAS NOW BEEN SOLD OUT - However you are welcome to join us at our Reception before the Dinner. Click HERE for further information

We will be hosting our Gala Dinner at Alameda Gardens on 19th May 7pm start. This year due to the size of the venue we will have less tables than our event in 2020. If you would like to secure your table in advance, please email us to request further information.

Tables can be reserved for £1500 or £150pp. To purchase a table / ticket please email the team at info@gfia.gi

Gala Reception Drinks

Our Gala Dinner has sold out but please join us at the Reception Drinks before hand.

Join us for a Black tie networking event with drinks, canapes and entertainment all in the beautiful setting of the Alameda Gardens.

Price £30 pp

Time : 7:00pm until 8.30pm

To reserve a place please email us at info@gfia.gi

Two part investment session with Paul Meadows

GFIA will be offering a two-part investment seminar. Presented by Paul Meadows, with fifteen years experience on the Buyside of the Equity Markets in the UK - Trader, Research Analyst & Portfolio Manager. Designing and delivering both public and in-house Financial Markets Training programmes worldwide since 2000.

The first half day (Part 1) will be on Understanding the Bond Markets and Understanding the Equity Markets. The second half of the day (Part 2) will be on Asset Allocation & Investment Risk Measurement and Management.

-

Following the Financial Market collapse over a decade ago, Banks sharply cut back on the availability of credit lines as Regulators forced them to hold more capital. Simultaneously, Governments increased their borrowing to shore up the surviving Banks. This was the opportunity for the Bond Markets to step in and become the provider of choice going forward to meet the Debt funding requirements of both Corporates, Supranationals & Sovereigns alike. Therefore it is imperative that these markets are properly understood by Issuers, Investors, Intermediaries, Regulators & Fund Administrators.

-

Understanding the Equity Markets.

The Equity Markets provide a venue for Corporates to list their shares, raise money & also offer Investors the opportunity to trade &/or Invest in already listed Companies. The function of these Markets is price discovery which is more readily achieved by high levels of participation, ranging from professional Institutional Investors all the way down to Retail Investors.

-

The management of expectation is almost as important as the management of Client funds. What matters is defining ‘Performance’. Understanding the full universe of Investable opportunities is what matters, and appreciating the importance of the Correlations between them to minimize risk and meet Client objectives. Risk management involves defining what level of risk is deemed acceptable, and then striving to target those appropriate levels. However, Risk cannot be managed easily unless it can be measured. There is no silver bullet out there for this task, but a range of tools to be employed where appropriate.

Price for Members:

Each Individual session £60 and £60

Both sessions £100

Price for Non-Members:

Each Individual session £90 and £90

Both sessions £150

Please email us at info@gfia.gi to confirm your space.

Training with XReg Consulting

The new Anti-Money Laundering Regime of the European Union: Regulations and Impact in Financial Services

Dimitrios Psarrakis and Ernest Lima [ XReg Consulting ] will be delivering a virtual training on the new anti-money laundering regime of the EU.

This training is a webinar which is £20 for members / £35 for non members.

To find out more about our new pricing structure for virtual events click HERE

In the seminar Dimitrios will update the members of Gibraltar Funds and Investments Association about the emerging AML regime in the European Union stressing the major impact they expect to have in the financial industry as a whole, they will underline the financial sectors mostly affected by these changes, and share their views on the impact they expect in the market. Please find below further background information from Dimitrios.

Background information

The European Union was one of the major regulators that understood fast the significance of digital finance and its disruptive capabilities in the value chains of the providers of financial services. Early on, it identified the importance digital finance to enter the market, first by allowing the transition to open banking (with the PSD2) and now it already moves from open banking to open finance (with a new PSD that is under way. Similarly, a set of new regulations was introduced to provide legal certainty in the field of crypto-assets, with MiCA and the DLT Pilot Regime addressing the challenges of the payment tokens, utility tokens and cryptographic securities, as well as the requirements for the providers of crypto-asset services. The digital finance Strategy introduced by the European Commission in 2019, includes aspects of the use of AI, the role of digital identity for onboarding customers and there are thoughts for the introduction of a new MIFID, that will reflect the technological changes of our time (MiFID 2.5).

Organic role in this wave of regulatory initiatives that we expect to change the European market structure, as well as the market structure of many other jurisdictions in the periphery of the EU, is the role of AML/CFT. European Union introduced in July 2020 a set of four new regulatory initiatives that reflect exactly the new technological challenges. The four pieces of regulation are the following:

1) The first European Anti Money Laundering Regulation;

2) A new Anti-money Laundering Directive;

3) The introduction of a new European entity responsible for the monitoring and compliance of the AML regime; and

4) A new regulation that transposes the FATFs travel rule of crypto-assets in the market of the EU.

The AMLR package is expected to introduce a rather uniform regime in the EU for AML purposes in financial services in a much more advanced way compared to the existing AMLD.

Town Hall Meeting

The Heads of each sub-committee will be providing an update on what GFIA’s focus will be on this coming year, what GFIA are currently working on and what to expect from the committee.

Gibraltar: Capital of Crypto Funds.

At 12.00 noon on Friday 8th October Gibraltar Funds & Investments Association (GFIA) will be hosting a lunch event at the Sapphire Room on board Sunborn Gibraltar Hotel & Casino Resort entitled "Gibraltar: Capital of Crypto Funds.".

The event will feature a discussion between Pavel Stehno, CEO of Sigil Fund, and James Lasry TEP, Deputy Chairman of GFIA covering all the main issues surrounding creating and managing a crypto fund in Gibraltar.

Entry to this event is covered by your ticket to Crypto Gibraltar so if you don't have one yet then please go to www.cryptogib.gi to secure your ticket now.